VITA (Volunteer Income Tax Assistance)

The Volunteer Income Tax Assistance (Vita) program offers free tax help to people who generally 54,000 or less, persons with disabilities and limited english speaking taxpayers who need assistance in preparing their own tax returns. IRS-Certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals.

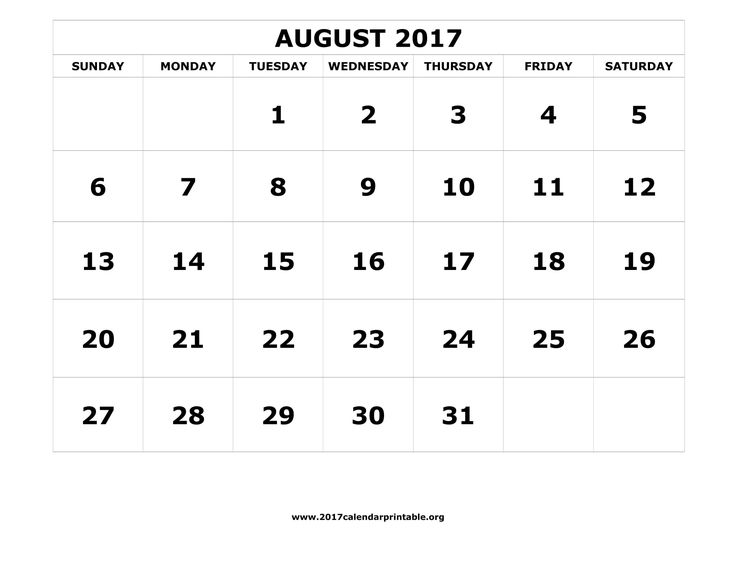

Due Date of Return:

The standard deduction for taxpayers who do not itemize deductions on Schedule A (Form 1040) changes every year. The standard deduction amounts for 2016 are:Must Watch Dates

- 11/21/17/: Sharing Deadline

- 12/25/17: Christmas Deadline

- 3/7/17:Tax Forms

Deduction Increases:

- $12,600 – Married Filing Jointly or Qualifying Widow(er) with dependent child

- $9,300 – Head of Household

- $6,300 – Single or Married Filing Separately

Earned Income:

- $3,373 with one qualifying child

- $5,572 with two qualifying children

- $506 with no qualifying child